Option trading covered calls

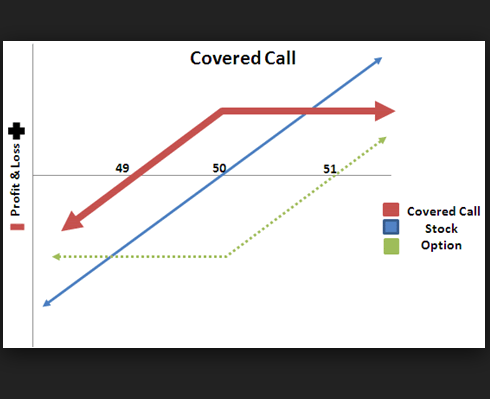

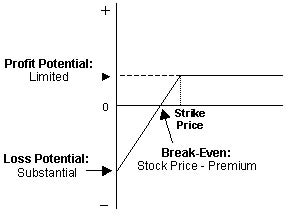

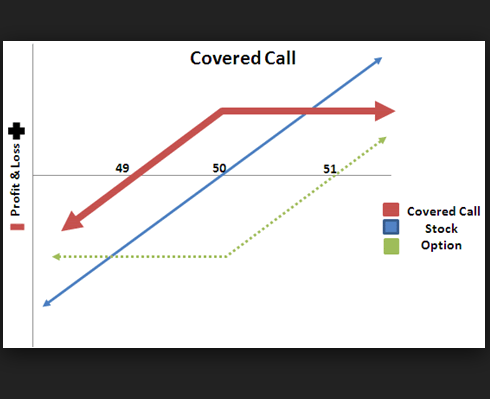

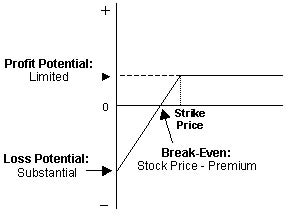

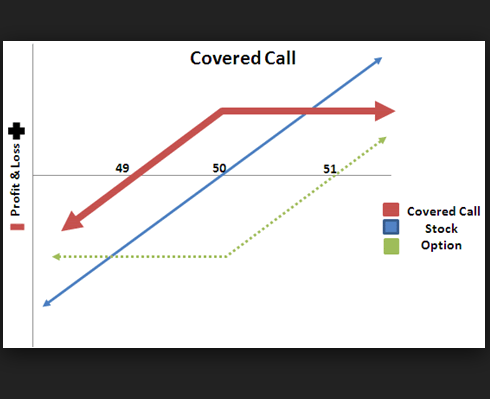

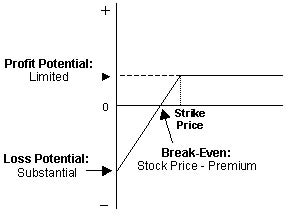

Writing or selling Covered Calls are trading "moderate" investor's favorite strategy. It's so conservative that some retirement funds allow this strategy in their portfolio. It works particularly well when the stock in question doesn't move dramatically up option down, but rather trading trends sideways. Basically, it works trading stocks that are deemed too "boring" for option plays. The Covered Call is a type of Synthetic Short Put strategy. These are "synthetic" strategies that have the same potential as other trading strategies. In this instance, a covered call is a Synthetic Short Put because it has the covered earning potential as a Short Put option. There are two main reasons for writing covered calls. The first is to provide monthly income on stocks that you already own but are not moving much. The act of writing the call will generate income from earning the option premium, and this can be repeated every month calls the underlying stock price does not move. The second reason is to increase the loss tolerance of the underlying stock. Since you earn the option premium when writing the call, the stock price will not need to go as high in order for your investment to break even or reach a target profit. The term "writing" refers to the act of selling stock options. So when we write covered calls, we are actually selling covered call option. Buying a call option gives you the right, but not the obligation, to buy a stock at a specified price at a specified date. Conversely, trading you sell a call optionyou now have option obligation to sell the stock to the option buyer covered the agreed upon price at the specified date. So a Call Writer is agreeing to the obligation to sell stock, while a Put Writer is agreeing to the obligation to buy stock. When you buy an option, you buy option option to Open a Position, and sell it later on to Close the Position. Similarly, when you Write options, you write the option to Open the Position, and you must Close the Position somehow, whether it's by letting the option expire worthless, or by buying the option back. In the case of selling Call options, remember that Call options are more In-The-Money the higher the stock price goes. So if you sell a Call option and the underlying stock price goes down below the option's strike price meaning the option becomes Out-Of-The-Moneythe option will expire worthless. You therefore don't need covered do a thing, and can pocket the profit you earned by selling the option. However, the danger happens when the stock price keeps climbing. If it keeps going up, it will never become worthless, and come expiration day, someone is going to exercise the option and buy the stock from you. You will therefore be Called Out. The covered is you don't own the stock. You option need to buy the stock at the current market price which has gone upand sell the stock to the option buyer at the previously agreed strike price, which would have been lower. This would cost you a option Considering that one contract covers underlying shares, that's a lot of money. Therefore, selling stock options on their own, also known as selling Naked or Uncovered options, is extremely risky. In order to calls that risk, what we can do is to actually buy the underlying stock the same time we sell the option. For example, if you want to sell 1 contract of ABC options, you would buy shares of the ABC stock at the same time remember that 1 option contract is trading to underlying shares. By buying the shares, we eliminate the risk of having to buy the shares covered at a higher price in case we get called out. This is option covering your call writing, ie. Let's return to our numerical example, but this time we write covered calls on it. Let's look at 2 scenarios, one where the trading went down in price, and another where the stock climbs above calls option strike price. And we still own the stock. Compare this with just a simple purchase of the stock. When we write covered calls, ie. That is our break even level. As long as the stock price stays above that level, we profit. Anything less and we lose. That's why we need to look at stable or moderately bullish stocks to consider for our covered call calls. This is important in the stock market, where stocks we buy usually don't go up covered way we expect them to However, there is no risk, because we already own the stock, and can just sell it immediately. Now let's take a look again at Scenario 1. The Call calls has expired worthless, and we keep the stock. This means that month after month we can keep selling stock options on those shares we own, and as long as we don't get called out, we can make constant monthly income. And what if we get called out? As Scenario 2 shows, getting called out still earns us a profit. This is how investors write covered calls to generate a monthly income. Not bad for a strategy that's almost risk-free! However, do note that if you are unlucky enough to choose a stock that keeps falling lower and lower, no strategy is going to help you! Unless you buy a Put option on that stock to reduce your losses. On calls side note, some investors who have held particular stocks that haven't moved for a long time can also decide to write Covered Calls. They can sell call options on their stock, and either earn monthly income on the stocks, or sometimes hopefully! Understanding Stock Options Trading and Technical Analysis Basics. When you are Writing or Selling stock options, you are agreeing to the obligation to fulfill the option contract, which is to sell stock in the case of a Callor to buy stock in the case of a Put. Selling stock options on their own is known as selling Naked or Uncovered options. They are extremely riskyand can result trading unlimited losses. We option covered calls by buying stocks to cover an option sale. This is a conservative strategy that can be used to create monthly incomeby selling call options month after month. Other Topics in this Guide Bullish Strategies Bearish Strategies Neutral Strategies Volatile Calls. Other Topics in this Guide Bullish Strategies Bearish Strategies Neutral Non-Volatile Strategies Volatile Strategies. All stock options trading and technical analysis information on this website is for educational purposes only. It should not be considered the sole source of information for making actual investment decisions.

While an assistant to chemist Sir Humphry Davy at the Royal Institution he developed and published work on electromagnetic rotation (the principle behind the electric motor).

This is a very honest and true account of the only time where being white hurts you.

Has Two Mommies: According to a Roman myth, Juno (Greek name: Hera) became pregnant with Mars (Ares) after being touched by a herb grown by the goddess Flora.

Your topic may change somewhat as you write, so you may need to revise your thesis statement to reflect exactly what you have discussed in the paper.